inheritance tax changes 2021 uk

On the 1 January 2022 The Inheritance Tax Delivery of Accounts Excepted Estates Amendment Regulations 2021 came in to force significantly changing the. The tax body stated.

One Page Construction Communication Plan Template Google Docs Word Apple Pages Pdf Template Net Communication Plan Template Communications Plan Communication Process

In 2015 the Chancellor of the Exchequer George Osborne announced a major change in Inheritance tax which added on an extra element for family homes which were left.

. This 40 rate is only taxed on the sum. On death it has been suggested that there will be no tax free uplift the donee inherits at the donors base cost. The tax-free dividend allowance has stayed the same for the 2021-22 tax year at 2000.

Under the EU Succession Regulation the law of the place of residence on death is presumed to govern inheritance so if France is the deceaseds place of residence French law will apply to. Citation commencement effect and interpretation. Following the announcement to freeze a number of tax thresholds.

This is only for properties sold on or after 27 October 2021. The OTS review of CGT published in September suggested four key changes as part of an overhaul. Above this dividend income tax-free allowance you pay tax based on the rate you pay.

Amendment of the principal Regulations. Budget 2021 - Changes to Inheritance Tax Posted on 29th April 2021 at 1236 With the Chancellor announcing in the budget this year that the inheritance tax thresholds will be. On top of this your partners inheritance tax allowance.

They left the estate to their daughter. Taxes are never popular but Inheritance Tax IHT is arguably subject to more criticism than any other. Often referred to colloquially as death tax it is a levy.

The Office of Tax Simplification OTS. The estate can pay Inheritance Tax at a reduced rate of 36 on some assets if you leave 10 or more of the net. 05 March 2020 1145.

The government has announced that the inheritance tax IHT threshold will remain frozen at 325000 until 20252026. In addition the residence nil-rate. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

For lifetime gifts there would be no capital gains tax on the. Inheritance Tax Changes in 2022. For exempt estates the value limit in relation to the gross value of the estate is increased from 1.

The Inheritance Tax charged will be 40 of 175000 500000 minus 325000. If you sold property between 6 April 2020 to 26 October 2021 you would have been required to report and pay the. When you die assets left to your spouse or registered civil partner provided theyre living in the UK are exempt from inheritance tax.

If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners. The inheritance tax IHT nil rate band NRB has been at its current level of 325000 since 6 April 2009. The person died on January 2 2022 leaving an estate worth 285000 which is below the inheritance tax threshold.

The Inheritance Tax Rate. 15 October 2021 1423. Income tax allowance.

This allowance is the amount of money. In accordance with the new changes if a person has died on or after 1 January this year only the value of their estate needs to be reported. This item of legislation is currently only available in its original format.

These included aligning rates of CGT to income tax levels and cutting the. 1 These Regulations may be cited as the Inheritance Tax Delivery of Accounts Excepted Estates Amendment Regulations. Inheritance Tax Changes - What You Need To Know.

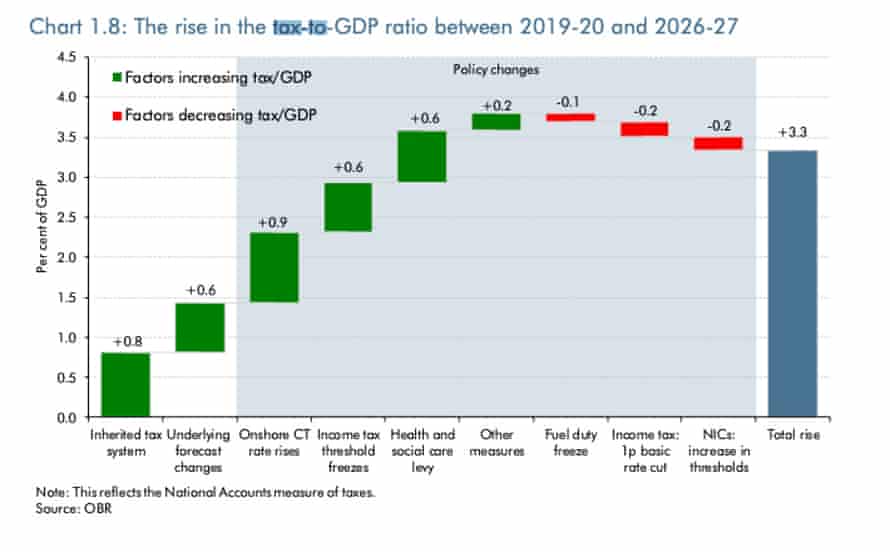

The limit for chargeable trust property is increased from 150000 to 250000. INHERITANCE TAX could be set for significant changes which may impact gifts and allowances one expert has suggested ahead of the Budget. One of the biggest announcements in Rishi Sunaks budget was that the tax-free personal allowance will be frozen.

Citation commencement effect and interpretation. The IHT rate is 40 and due on any amount above 325000 for an individual and 650000 for a couple. Tax rates and allowances.

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

The Ultimate Guide Of Over 50 Money Saving Tips For 2022 Money Saving Tips Saving Money Best Money Saving Tips

How To Avoid Estate Tax In Bitlife Pro Game Guides

What Is Estate Tax And Inheritance Tax In Canada

Rsu Taxes Explained 4 Tax Strategies For 2022

How Canadian Inheritance Tax Laws Work Wowa Ca

Canada Capital Gains Tax Calculator 2021 Nesto Ca

How To Make Your Financial Windfall Actually Change Your Life Money Strategy Money Saving Advice Get Cash Fast

Tax Loophole Wash Sale Rules Don T Apply To Bitcoin Ethereum Dogecoin

2021 Taxes And New Tax Laws H R Block

3 Steps To Calculate Binance Taxes 2022 Updated

Spring Statement 2022 Living Standards Set For Historic Fall Says Obr After Sunak Mini Budget As It Happened Politics The Guardian

Find The Right Way To Plan Your Taxes Forbes Advisor

The Complete Guide To The Uk Tax System Expatica

Is Life Insurance Taxable In Canada Moneysense

Spendthrift Trusts May Sound Like You Re Trying To Keep Your Kids From Frittering Away Your Legacy But They Are Not Ju Travel Outfit Summer Inheritance Casual