IR35

The intention of IR35 is to ensure that if the relationship between a contractor and their client. IR35 legislation is a set of rules that ensures those who work as employees but through their own limited companies or personal service company PSC pay a comparable level of income tax as those employed directly.

Ir35 Changes From 6 April Explained Rocket Lawyer Uk

Fill in the yellow boxes to calculate your net income inside and outside IR35.

. IR35 was introduced in 2000 and the IR35 rules became law via the Finance Act 2000 Schedule 12 to challenge tax and National Insurance Contribution NIC avoidance schemes. IR35 is tax legislation intended to stop disguised employment. With some individuals providing their services.

The off-payroll working rules apply on a contract-by-contract basis. The definition of small business for IR35 exemptions is likely to be based on the definition in the Companies Act which is met if a company meets any two of the three triggers below. Annual turnover Not more than 102 million.

Browse Our Site Today. The IR35 rules ITEPA 2003 Part 2 Chapter 8 will not be repealed this is a misconception which has emerged on forums. The IR stands for Inland Revenue and the 35 is the press release issue number.

Speaking to the House of Commons today September 23 Chancellor Kwasi Kwarteng said from April. What Is the IR35 Legislation. Outside IR35 What is clear is that if youre outside IR35 youll.

On demand overwrite xerox 7855. Essentially IR35 affects all contractors who do not meet the Inland Revenues definition of self-employment. Portable air conditioners at walmart.

The IR35 reform will be repealed from April 6 2023 according to this mornings mini-Budget. IR35 denotes the UK tax legislation designed to tax disguised employment at a rate similar to normal full-time employment. Printable princess coloring pages.

Wed like to set additional cookies to understand how you use GOVUK remember your. IR35 is a piece of legislation which allows HMRC to treat private contractors as if they were employees. List of information about off-payroll working IR35.

Ad Global Leader In Industrial Supply And Repair Services. The legislation was designed to stop contractors working as disguised employees by taxing them at a rate similar to employment. The term IR35 refers to the press release that originally announced the legislation in 1999.

Chancellor Kwasi Kwarteng has pledged to simplify so-called IR35 rules which affect self-employed individuals operating through a company in his mini-Budget. IR35 is the abbreviated name for the anti-tax avoidance legislation that was introduced in April 2000. How to use the IR35 calculator.

IR35 is governed by Her Majestys Revenue and Customs. Travel expenses cover any travel subsistence and accommodation costs incurred on contract duty. It is aimed at combatting tax avoidance by workers typically contractors and freelancers who supply their personal services to clients via an intermediary such as their own limited company a PSC.

The calculator assumes you work 5 days per week 44 weeks per year. The government will repeal these reforms. IR35 has become the nickname for HMRCs off-payroll working rules that are part of the Finance Act.

September 23 2022 134 pm. The IR35 tax avoidance reforms were first introduced in the public sector back in April 2017 and ushered in a sizeable shift in responsibility within the extended end-client-to-contractor labour. A contract for the purpose of the off-payroll working rules is a written verbal or implied agreement between parties.

The original press release outlining the details was called IR35. Balance sheet total Not more than 51 million. In general IR35 shifts the responsibility of worker classification from self-employed individuals working through their own limited company to in.

IR35 also known as the Off-Payroll Working Rules may apply when the freelancer operates under a personal services or similar company. What does IR stand for in IR35. IR35 reforms introduced in the public sector in 2017 and the private sector in 2021 meant that the responsibility for determining a contractors worker status shifted to the organisation engaging their services.

Its sometimes called intermediaries legislation because it involves an employer hiring a. We use some essential cookies to make this website work. IR35 affects all contractors who do not meet HMRCs definition of self-employment.

It was introduced to combat the problem of disguised employment where employees offer their services via limited companies to pay less tax and National Insurance.

What Kwarteng S Ir35 Changes Mean For Businesses Ftadviser Com

What Is Ir35 Off Payroll Changes For Self Employed Thinkremote

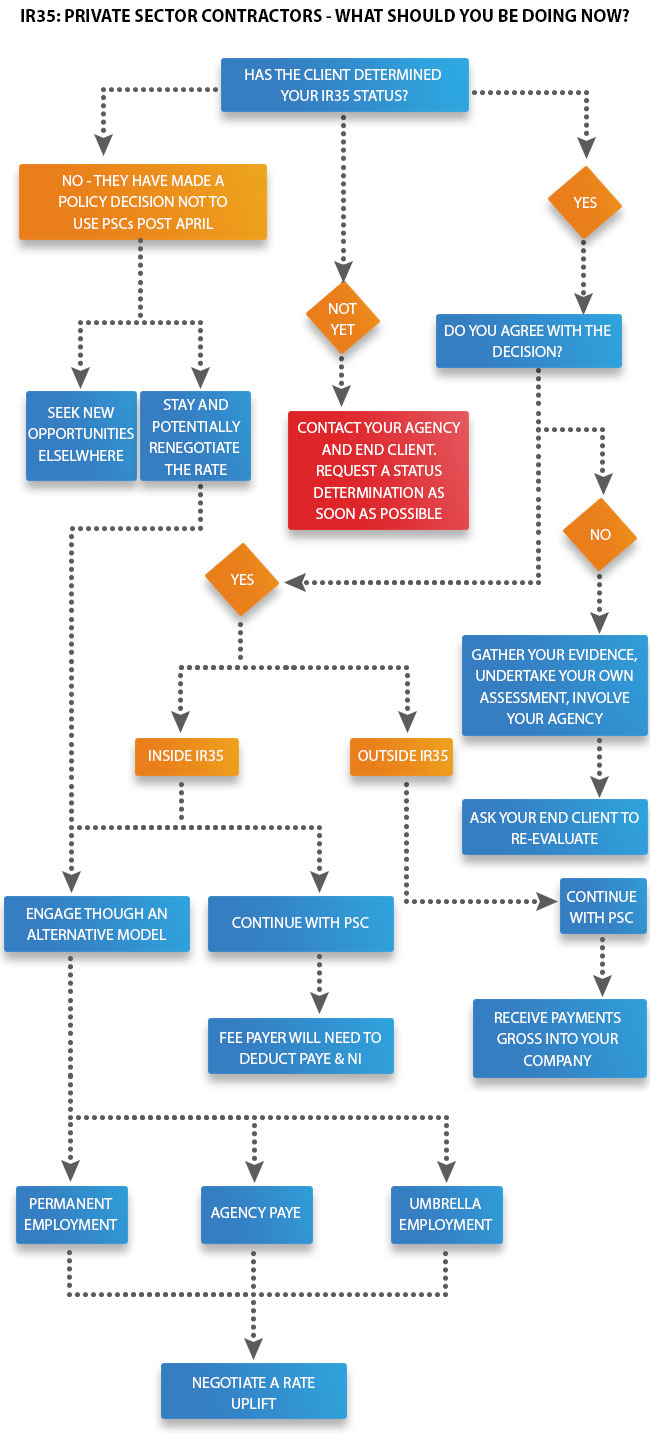

Working Through Hmrc S Off Payroll Ir35 Rules A Step By Step For Pscs

Azure Virtual Desktop And How It Helps Organisations And Their Contractors With Ir35

What Is Ir35 And Why Is It Dangerous Ground For Independent Contractors

Hmrc S Ir35 Change An Opportunity For Consulting Firms

Changes To The Off Payroll Working Rules Ir35 Meridian

Worried About Ir35 Don T Fret The Tech Wrap By Ben Martin

What You Need To Know About The Uk Ir35 Rules Goglobal

What Is Ir35 Here S What You Need To Know Freshbooks Blog

Ir35 Reform April 2021 What It Means For Companies In The Usa Cxc Global

New Ir35 Private Sector Rules What Do They Mean For Those Using Contractors Thorntons Solicitors

An Introduction To Ir35 And It S Possible Impact On Private Sector Contractors

Ir35 Reform April 2021 What It Means For Companies In The Usa Cxc Global